Manias, Panics, and Crashes: A History of Financial Crises

by Charles Kindleberger

This is the classic account of the life cycle of financial crises, how they happen, but more importantly, how they build, spread and take on lives of their own. Kindleberger’s book carries the message that, while policies may change and economic circumstances may vary, human psychology and oscillation between fear and greed will always be with us.

Recommendations from our site

“Kindleberger’s message is that complacency can be a self-denying prophecy.” Read more...

The best books on Globalization

Larry Summers, Economist

“Kindleberger’s great virtue is that he was both a respected economist and a student of human nature, and he knew that human nature could never be bottled up in an economic model. His book is a terrific narrative of a series of bubbles, going back to pre-industrial days – the Dutch tulip craze, the South Sea bubble, and so forth..” Read more...

The best books on Financial Crashes

Charles Morris, Entrepreneurs & Business People

“He describes very well how these manias occur and what the symptoms are of manias in terms of excessive speculation, overleverage, borrowing, fraud, embezzlement, high trading volumes, and so forth.” Read more...

Marc Faber, Fund Managers & Investor

Our most recommended books

-

The Big Short: Inside the Doomsday Machine

by Michael Lewis -

This Time Is Different

by Carmen Reinhart & Kenneth Rogoff -

A Monetary History of the United States, 1867-1960

by Anna Schwartz & Milton Friedman -

Essays on the Great Depression

by Ben Bernanke -

The Crucial Years

by Dorothea Lange -

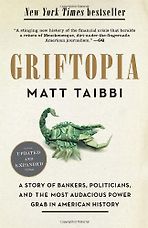

Griftopia

by Matt Taibbi